Knightscope Security robot, ROSS at Springline, Menlo Park, CA

Knightscope Security robot, ROSS at Springline, Menlo Park, CA

Unlocking Opportunities of Technology to Enhance Value

Issue 004

Technology fuels our competitive edge, enhances the value of our assets, drives new forms of demand, and ensures we continually adapt and expand the utility of the built environment.

In the late 1960s, Watts S. Humphrey led a team that introduced IBM’s first software license, and later wrote a book declaring “every business is a software business.” Over the decades, Humphrey’s mantra evolved into “every company is a technology company.” A Google search for the phrase yields four billion results, compelling evidence of how mainstream the notion has become across most industries.

But real estate has been a notable exception. “The property industry is notoriously slow moving and the vast majority of organizations are followers rather than trailblazers, waiting for others to pave the way,” noted a report from consulting firm KPMG. “But it can be a brutal fall from grace for those who miss the opportunity to adapt to the rapidly changing globwial environment.”

“The property industry is notoriously slow moving and the vast majority of organizations are followers rather than trailblazers, waiting for others to pave the way.”

— KPMG Report

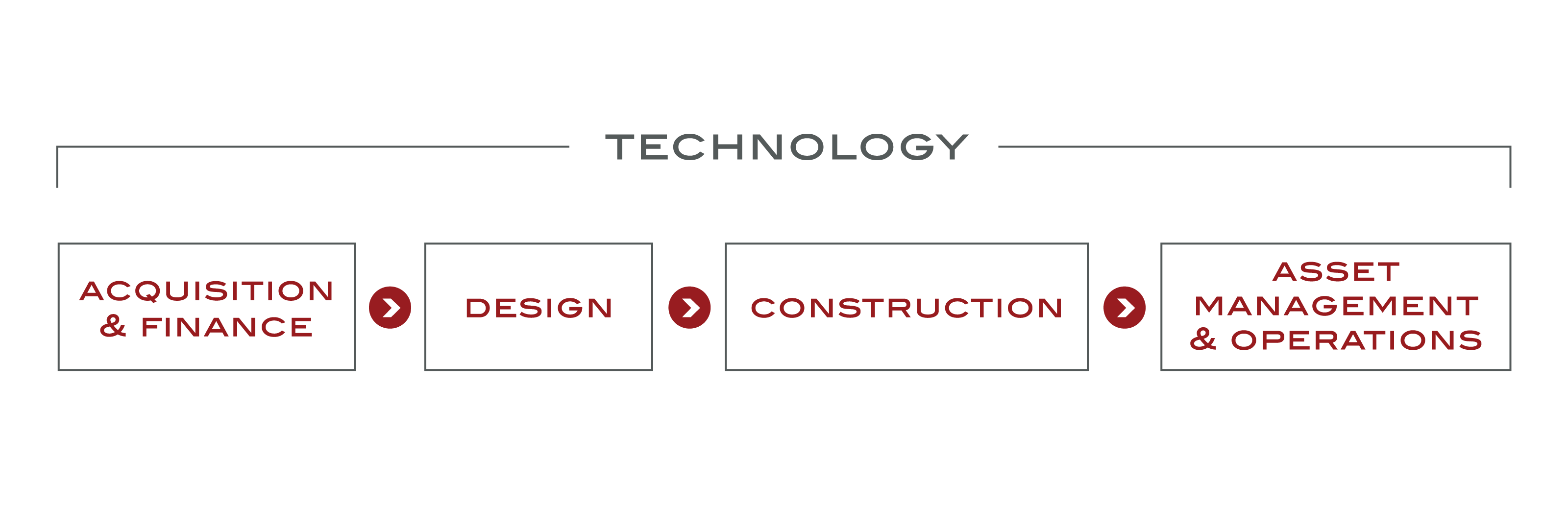

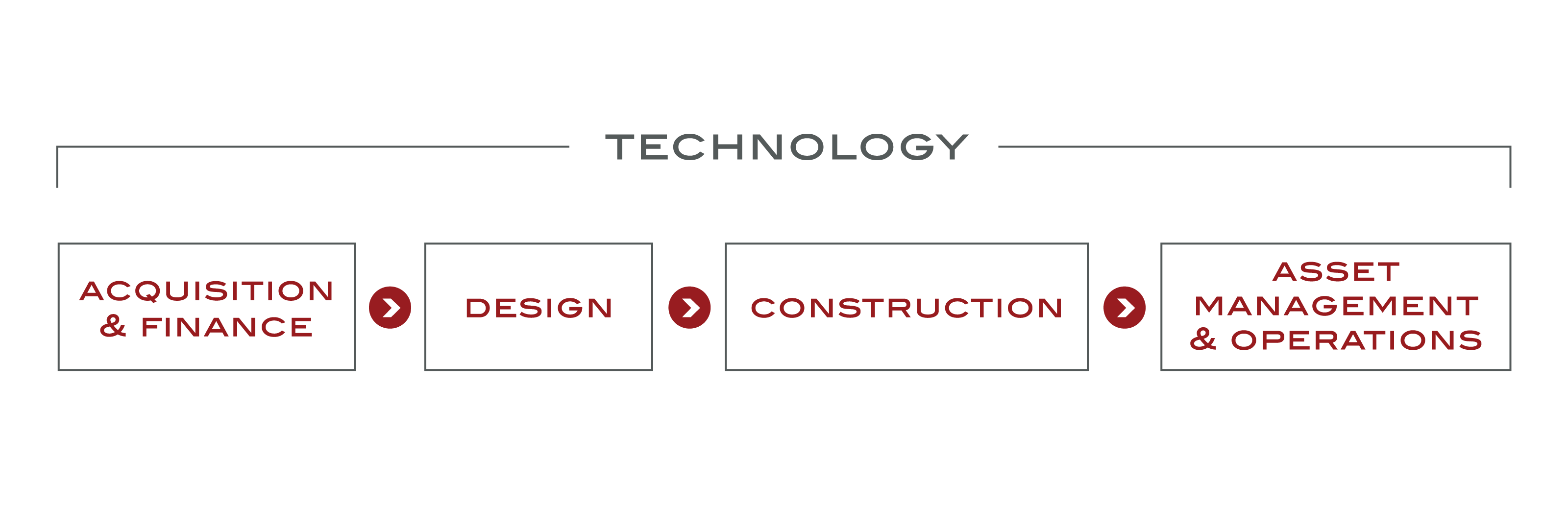

At Presidio Bay Ventures, the desire to embrace new technology is deeply embedded in our DNA. Technology fuels our competitive edge, enhances the value of our assets, drives new forms of demand, and ensures we continually adapt and expand the utility of the built environment. From our vantage point in San Francisco, Presidio Bay has witnessed the spectacular convergence of technology upon a diverse array of industries that directly impact the way we think about and interact with our physical surroundings. As VC investor Marc Andreessen described it in his seminal Wall Street Journal article more than ten years ago, “Software is also eating much of the value chain of industries that are widely viewed as primarily existing in the physical world.” We started our firm with a vision to establish a comprehensive technology stack that touches everything from corporate operations to the design, engineering, construction and management of the physical asset. Our proactive, end-to-end approach is rare in the industry, which tends to focus on piecemeal improvements.

As the KPMG report explained, the adoption of technology in real estate is “often also a defensive reaction to perceived challenges, rather than a holistic strategy that really grasps the opportunity that successful digital transformation enables.” At Presidio Bay Ventures we are committed to seizing that opportunity. Our goal is connectivity at scale, with technology integrated in every process, at every step, from ideation to asset creation, through ownership and management of the real estate.

In a recent report, Boston Consulting Group noted, “The purpose of becoming a technology company should not be primarily to defend market share—above all, it should be to benefit from the enormous opportunities that technology can unlock.” As an advocate, thought partner, investor and evangelist for startup innovators, Presidio Bay Ventures gains better insight into the landscape of innovation so we can successfully unlock the most promising opportunities. We are working to identify the right solutions and weave them together in a comprehensive tech ecosystem to:

- optimize corporate-level operations;

- streamline and accelerate project execution, including design, construction, and engineering technology;

- build smarter, more efficient properties that yield a superior customer experience and not only meet but predict consumers’ ever-changing needs;

- procure real-time, high-quality data to monitor building systems and understand our occupants’ behavior, and in turn drive continual operational improvement, lower cost and higher asset value;

- enhance asset management to ensure long-term value creation and preservation.

In this paper, we discuss Presidio Bay’s mindset and values, why we provide early-seed capital to PropTech firms, and the benefits and challenges of technology integration. We believe every company is a technology company. By remaining true to this North Star, we can reliably differentiate our product offering; provide a best-in-class experience for our residents, commercial occupants, their employees and customers; and create price elasticity that leads to premium rents, raising asset values for our investors.

Commercial real estate tends to be an insular, often generational enterprise, and a fragmented one, with millions of mom-and-pop operators. The business is traditionally viewed by participants as a spreadsheet-driven, space-delivery model, instead of the consumer-facing product and service it actually is. Digital innovation is often seen as an added cost burden rather than a necessity, and landlords may lack tech talent in both leadership and the front lines.

Six in ten landlords surveyed by EY consulting say “competing priorities” delay progress toward tech adoption. The industry has a “traditional if-it-isn’t-broken-don’t-fix-it culture toward legacy systems that continue to function,” the EY report stated. “Closely linked to that attitude is the view that technology to improve efficiency and reduce cost has never been part of the traditional real estate value-add playbook — at any rate, not to the extent that building improvements or tenant-turnover issues have.”

As a result, commercial real estate has been particularly slow to adopt technology, and is “playing catch up with other industries,” noted a KPMG report. “The financial services, pharmaceuticals, and automotive industries, for example, have more mature tech elements, and in some instances technology has become the ‘new normal’ rather than an add-on.”

Digital innovation is often seen as an added cost burden rather than a necessity, and landlords may lack tech talent in both leadership and the front lines.

To understand the tectonic shift in expectations among residential and commercial tenants, just open any smartphone. It provides immediate access to knowledge, shopping, entertainment, health data and relationship-connections in the palm of one hand, delivered with convenience, ease, speed and consistency. The COVID-19 pandemic accelerated digital adoption by as much as a decade, with consumers over age 65 comprising the fastest-growing cohort.

These experiences are rapidly becoming the baseline for the way consumers will demand to interact with all product and service providers, including landlords. “Digital solutions have democratized access to experiences and conveniences for individuals and companies,” said Clay Cowan, a McKinsey partner. As consumers have adapted to online shopping, tele-health and financial services, for example, “they expect similar from the spaces in which they live, work, play, and shop.”

“As consumers have adapted to online shopping, tele-health and financial services, for example, they expect similar from the spaces in which they live, work, play, and shop.“

— Clay Cowan, McKinsey

Ironically, many of these apps were created in the Bay Area, yet our real estate is stuck in the Stone Age. Tenants still sign paper leases and pay rent with paper checks. They unlock their doors using a metal tool invented in the 6th century BC. They dial a phone and leave a voice message to get help with needed repairs, hoping someone eventually responds. If they connect with their neighbors, it’s probably in the lobby rather than a proprietary digital platform.

But this is rapidly changing. “The future of real estate is no longer about delivering four walls to tenants,” explains Scott Rechler, CEO of RXR, an East Coast developer, owner and manager. “Instead, it’s about creating a unique, personalized customer experience that fosters meaningful interactions, collaboration, and productivity. Delivering this will require a unique combination of capabilities that seamlessly integrate across the physical and digital realms.” RXR created a $50 million PropTech fund in 2018, and announced plans for a $250 million PropTech special-purpose acquisition company (SPAC) in 2021.

“Instead, it’s about creating a unique, personalized customer experience that fosters meaningful interactions, collaboration, and productivity. Delivering this will require a unique combination of capabilities that seamlessly integrate across the physical and digital realms.”

— Scott Rechler, CEO of RXR

Presidio Bay deploys technology to elevate the tenant experience, enhance the value of our real estate portfolio and future-proof our investments. As a strategic advisor, we help PropTech firms prototype and refine their product offerings, scale their operations, grow their customer base, and source funding from investment partners. Where we have a relationship with the founding team, we leverage our leadership’s experience in real estate development and technology investment banking to source and underwrite direct investments. We focus on companies that provide products or services to the government, finance, consumer, workflow/project management, security, design, construction, and analytics industries. We aim to discover and propagate the best solutions and integrate them in a comprehensive technology stack. Our efforts are concentrated on five primary verticals: product delivery, tenant satisfaction, sustainability, asset management, and industry-specific collaboration and productivity tools.

On the product delivery front, we invest in design, engineering, and construction technology to reduce costs, improve coordination, speed to market, and make the process more efficient. Construction is a $10 trillion industry, and venture capitalists have invested billions in startups seeking to disrupt the process. But every project is unique – built on a particular site, with a specific crew, under a certain regulatory regime and in distinct weather conditions — and is executed in a series of one-off, interlocking steps. Specialists in the building process may be reluctant to adopt new technology, because they are responsible for implementation but typically don’t capture the financial upside of the investment. Meanwhile, any glitches along the way quickly cascade downwards. As structural engineer Brian Potter explained, “Construction project costs are right-skewed and fat tailed; costs can easily end up being 50 to 100% higher than projected, or more. Preventing this requires closely monitoring all the processes taking place on a project, and understanding how they influence each other. Construction innovations thus tend to be incremental and evolutionary, things that don’t change the underlying processes.”

We help PropTech firms prototype and refine their product offerings, scale their operations, grow their customer base, and source funding from investment partners.

The Menlo Park-based firm Katerra raised more than $2 billion to vertically integrate technology solutions across the building lifecycle, offering software to better design and manage projects, and prefabricated components to reduce carbon emissions. Unfortunately, the company is now better known as a cautionary tale of the capital-intensive and technically complex nature of innovation within the industry. Despite its substantial warchest, Kalterra expanded too quickly and spread itself too thin, ultimately filing for Chapter 11 protection in June 2021 with more than $3 billion in project backlog.

But the company helped blaze a trail that other innovators will inevitably follow. “There were many innovators inside the company who will be taking their learned lessons forward into new ventures,” said Matthew E. Wheelis, Vice President of Industry Strategy, Build & Construct Division, with Nemetschek Group, a construction software firm. “Significant effort, thought and resources went into their technology platform, and the people that drove it are unleashed to innovate further and differently. This is good news for the market.”

As for sustainability, we implement systems to monitor energy consumption by occupant or unit and provide data insights that lead to better building performance. These technologies also meet tenant expectations for conservation: An EY survey found that post-pandemic, nearly half of people plan to prioritize the environment and climate change in how they live and the products they buy; for 26 percent, sustainability will be their most important purchase criteria three years from now. Moreover, our emphasis on green technology helps meet the goals of investors and occupiers dedicated to environmental, social and governance (ESG) mandates.

Sustainability is also tied to livability and well-being. Residential and commercial occupants want spaces where they can thrive, whether it’s better lighting and air quality, or a clearer understanding of their carbon footprint. Healthier, more eco-friendly environments are in the spotlight post-pandemic: 57 percent of consumers say they want to make healthier choices in their product purchases in the longer term, according to the survey by EY consulting. Some 43 percent say health or “what’s good for me” will be the most important purchase criteria for them three years from now. Technology also helps us deliver the same high-tech experiences in the built environment that occupants enjoy in other aspects of their lives. We invest in innovations that maximize space utility, simplify guest access, automate the reservation and use of amenities, help occupants communicate with neighbors, and control appliances, lighting and thermostats – among others. Such features distinguish our buildings from a tenant standpoint, which ultimately drives performance of the asset in the market.

Finally, technology enhances our asset management, corporate processes, and organizational structure. We use building management technology to provide real-time visibility into the critical infrastructure in our properties. We can spot and address performance issues more quickly and collect an array of data to produce actionable insights. Software improves transparency in our asset management and streamlines and optimizes our corporate processes. This yields higher internal productivity from our teams, as well as better internal financial controls and investor relations. Finally, our technology philosophy drives our organizational structure. We modeled our firm after agile software developers, with flat teams that facilitate the free flow of information and expertise to propel productivity. As tech founder and author Chris Clearfield noted, “…today more than ever, there is a recognition that leading with technology requires a critical focus on people and processes, not just the technology itself.”

Residential and commercial occupants want spaces where they can thrive, whether it’s better lighting and air quality, or a clearer understanding of their carbon footprint.

Real estate is the world’s largest asset class, and PropTech firms deploy digital innovation to help individuals and companies research, buy, sell, and manage it. While total global venture funding rose 4 percent to $300 billion in 2020, the top ten PropTech deals raised just a fraction of that — about $2 billion, according to one analysis. Still, the sector is growing quickly. In 2021, there were more than 2,200 PropTech companies in the U.S., with about one-third located in three cities: New York, San Francisco and Boston, according to Unissu, a global platform that connects and educates PropTech buyers and sellers. Researchers at the Saïd Business School, University of Oxford, group innovations in three broad categories:

- Real Estate FinTech, which facilitates the trading of ownership, such as digital payments and crowdfunding platforms;

- Shared Economy innovation, which involves the use of assets, such Airbnb and WeWork;

- and Smart Real Estate platforms, which seek to improve the operation and management of assets, and includes the Internet of Things (IoT), home automation, energy management and security.

Our definition includes Construction Tech, or ConTech, which fosters better design and construction of buildings.

Younger generations in particular are used to seeing constant disruption and are quick to adopt new technologies.

As PropTech investors, Presidio Bay Ventures can vet, advise on, and validate products, helping companies get from cutting-edge to mainstream. We can assist startups in clarifying their customer base and value proposition. We have insight into the preferences of their ultimate client base, which can change rapidly; younger generations in particular are used to seeing constant disruption and are quick to adopt new technologies. We can help iterate their product, prove the concept through our portfolio, and build relationships in the industry.

Seed investing with startups is still relatively rare in the business. A KPMG survey found just 14 percent of real estate firms were “very actively” looking for collaboration with technology partners. Only 30 percent of traditional real estate firms said they invest in or were looking to invest in PropTech startups. The biggest PropTech VC funds include Fifth Wall, in Los Angeles; Camber Creek, in Washington, D.C.; New York-based MetaProp; San Francisco-based Brick & Mortar Venture; and the JLL Spark Global Venture Fund. JLL is the only one managed by a major commercial real estate firm. Presidio Bay is positioned as an “operator capitalist,” similar to Amazon, Stripe, and a host of other companies diving into the venture space to diversify, stay competitive, and actively participate in innovations taking place within their industries.

We can help iterate their product, prove the concept through our portfolio, and build relationships in the industry.

While PropTech growth prospects may be strong, significant challenges remain. First, too few PropTech entrepreneurs truly understand the real estate business, or the end-customer. “I have seen brilliant teams offer fantastically creative solutions, only to learn that no one wants to buy it, or that the problem itself is slowly going away as the general state of technology improves,” said David Gerster, an investor with the JLL Spark Global Venture Fund. “This is an easy trap to fall into for both entrepreneurs and investors: the technology itself is so cool, you forget to ask how useful it actually is (and will be in the future).”

James Dearsley, co-founder of Unissu, agreed. “I feel the lack of actual industry knowledge may be the fundamental reason their seemingly great ideas fail. Most will never have got involved with buying a commercial property or leasing one — let alone being a commercial agent.”

A lack of industry knowledge can cause startups to misidentify their customers. For example, many hardware companies will go directly to owners and landlords, when frequently they may not be the decision makers. Sometimes, the architect makes that call, or the capital partners, subcontractors, or electrical subcontractors. “Finding the right stakeholder within a business to champion the trialing or adoption of new technology remains nearly as hard for innovative start-ups as developing the technology itself,” said Geoff Dunnett, Real Estate Director of Shieldpay, a payment solutions firm. “This inevitably means that great technology may slip through the net of most, some innovations will not see the light of day or, in the worst cases, the competition pounces on the opportunity and will gain material advantages.”

“I feel the lack of actual industry knowledge may be the fundamental reason their seemingly great ideas fail. Most will never have got involved with buying a commercial property or leasing one — let alone being a commercial agent.”

— James Dearsley, Unissu

Meanwhile, technology can be hugely expensive. Presidio Bay has been adopting models that allow us to absorb costs by amortizing them over a much longer period of time. This means we can capture the value of the solution and pass on the costs to tenants over years, creating a win-win for everyone. It helps that we are long-term holders of the assets we build. Other developers may be loath to take a risk on technology that increases asset values beyond their ownership lifecycle; and multiple stakeholders can thwart investment momentum.

Finally, developers have finite windows of time to make long-lasting decisions. Once the ball is moving – the design is set, the project is in planning, entitlement and pre-construction – the built environment is not very malleable. There is a point in a project lifecycle at which it becomes much more difficult to implement technology. Very early on, we try to be as thoughtful as possible and make key decisions around what areas to integrate tech products, what providers are servicing these project areas, how early they can be brought into the process, and, most importantly, whether we can work together to develop mutually acceptable solutions.

Fortunately, our deep involvement in PropTech investment gives us insight into the landscape of innovation, and we work to design flexibility whenever possible into our processes. “Emerging technologies may sometimes seem a long way off … but they all have the potential to increase the spectrum of risks for property owners,” a KPMG report noted. “It is critical that the industry carefully considers both the direct and indirect potential impacts of these and builds flexibility into both their buildings and businesses, in order to react quickly as they materialize. … When you consider the lifespan of buildings, and the lead time for new developments and changes to existing plans, it is vital that property players take long-term changes and trends into account when making decisions – black swan events can often be predictable if you know where to look.”

“Finding the right stakeholder within a business to champion the trialing or adoption of new technology remains nearly as hard for innovative start-ups as developing the technology itself.”

— Geoff Dunnett, Shieldpay

To understand how Presidio Bay Ventures engages with startups, it’s worth examining one of our success stories. We invested early in Latch, a maker of smart locks and building-management software. The company’s operating system provides a seamless, intuitive and mobile-first access control that moves away from the traditional key but maintains security and peace of mind for the owner-operator. With Latch, residents use a smartphone, code, or physical key to unlock their door, and can text a temporary code to provide entry to dog walkers, maintenance workers and other visitors. For added security, the Latch locks are also equipped with a discreet security camera feature. Device fleet management and activity monitoring is entirely cloud-based and accessible by tenants, staff and service providers at various permission settings, giving our team an efficient tool to manage access control while eliminating significant challenges associated with tenant turnover and multi-visitor environments that we frequently encounter in our multifamily assets.

From start to finish, we enjoyed a close relationship and direct line of communication with the founding team, which was critical to the success of our implementation. Latch provided a smooth onboarding experience in terms of identifying which of their products best fit our development. We integrated Latch into our construction costs early on by introducing the firm to our architects, door hardware suppliers, and general contracting teams. We made sure that the products we were expecting were included in our construction drawings so that when they were ordered, we knew who needed to receive them. Rather than trying to compete with door frames and hardware subcontractors directly, Latch did an excellent job correctly identifying the right channel partners in their customer markets, so our general contractor was aware of precisely where the products would be sourced from, which subcontractors would receive the products, when they would be on the site, and when they would get installed. As issues arose, we were able to have collaborative conversations with Latch, the channel partner and subcontractor that were key to resolving coordination, installation, and repair issues.

In 2021, Tishman Speyer Properties took Latch public by merging it with a SPAC, TS Innovations Acquisitions Corp., raising $453 million from the public offering (NASDAQ: LTCH). With this new round of funding, we expect to see a wide range of new products introduced and these products rolled out at scale by some of the industry’s largest developers.

By embracing a value proposition with technology at the core, Presidio Bay Ventures demonstrates the mindset required to succeed in a digital age. As Boston Consulting Group noted in a recent report, becoming a technology company is about having “a ‘restless change’ mindset, a mix of intellectual attributes such as ambition, optimism, imagination, a questioning spirit, a tireless pursuit of new ideas, and a defiant persistence in the face of daunting odds. It is also this mindset that enables companies to attract good—even the best—people.”

To be successful, our company’s restless change mindset must remain intensely focused on the customer. We are constantly watching for new technologies that have the potential to disrupt an array of other verticals, including architecture and land planning, investor platforms, transportation, food, and regulatory approval efficiency. Through shifting trends and inevitable future disruptions, concentrating our technology on people will provide the intelligence to continually understand their needs, anticipate their future desires, and develop winning solutions to meet them.

Through shifting trends and inevitable future disruptions, concentrating our technology on people will provide the intelligence to continually understand their needs, anticipate their future desires, and develop winning solutions to meet them.

Springline is our 6.4-acre mixed-use development located in Menlo Park, California. The property includes two 100,000-square-foot Class A+ office buildings, 183 residences, exclusive retail and dining options, and a dual-level subterranean parking garage. Public outdoor space is tailor-made for one-of-a-kind experiences, gatherings, and events for both tenants and the surrounding community.

Springline is located in Silicon Valley, just a stone’s throw away from private equity and venture capital firms. We took our location in the ecosystem and partnered with our tenant Canopy to create a co-working hub for technologists and entrepreneurs. Canopy’s shared workspace builds a foundation of creativity and innovation that flourishes through the diversity of thought and a blending of complementary skill sets, experiences and viewpoints.

Springline and Canopy support the needs of modern teams for flexible space, where people can come together and collaborate and create. Canopy is positioned to become the proverbial ‘garage’ where new companies are built. Presidio Bay Ventures will sponsor demo days and various events to foster a hub of innovation and creativity. Our goal is to bring together the product, the founding teams, the investors, and the customers within a physical, or “phy-gital,” environment at Springline.

In addition, with its mix of uses and a public component, Springline has been a focal point and testing ground for many of our operational technologies. We thought deeply about how to elevate the customer experience, improve connectivity, optimize space usage, track and manage energy consumption, and maximize health and wellness. We hope to ultimately encourage our tenants, users and visitors to engage with the property in the hopes of producing actionable insights. Here are some highlights of our technology implementations, with a specific focus on the companies and products that we are bringing together at Springline.

BUILDING OPERATIONS

Rise Buildings

Rise Buildings is a mobile app provider that integrates multiple real estate systems to enhance the tenant experience and integrate it with property operations. For example, the platform integrates directly with in-place property management, access control, and sensor systems, as well as amenities and elevators. Rise solutions include access and visitor management, health and safety, property operations, and tenant experience. The platform provides a single place for Springline tenants to open doors, pay rent, reserve amenities, receive building news, and communicate with neighbors. Rise also provides data that enables actionable insights. Through Rise, we will have a better understanding of where and when certain areas of Springline are being populated or visited, potentially informing decisions about their use, such as on how retail space is curated.

Enertiv

Enertiv is a connected SaaS platform that brings together modern software tools to digitize operations and provide real-time visibility into the performance of critical infrastructure. Through constant monitoring, Enertiv can sense performance issues such as leaks in a building and notify property management staff. The system provides better transparency into maintenance, energy efficiency, capital planning, tenant billing, the indoor environment, and more. Enertiv can break down energy consumption and utility consumption by tenant or unit, and provide data insights that lead to more efficient building performance and better tenant experiences. The platform has been shown to increase net operating income while delivering a payback period of under a year. Enertiv will be crucial to solving the challenges around data collection with regards to ESG targets for both the building and tenants.

Savioke & Knightscope

Springline will be one of the communities to employ the use of autonomous robots to deliver everything from take-out to contracts, lattes to flowers while also managing on-site physical security. Savioke’s Relay system has a lockable payload with trackable navigation to ensure packages are delivered safely and securely while they seamlessly navigate elevators and multiple floor layouts. Relay will allow Springline to deliver unparalleled convenience and engagement with our tenants. Meanwhile, Knightscope provides a range of autonomous security robots (ASRs) that offer security patrols as well as a physical presence that deliver real-time, actionable intelligence anytime and anywhere, giving our security team the ability to detect and react faster to incidents occurring across the expansive 6.4-acre site.

Bbot

Bbot is a restaurant and hospitality tech startup dedicated to simplifying and improving the ordering and payments process. Bbot offers a configurable solution for restaurants, bars, hotels, cinemas, and other hospitality organizations to create digital menus and provide guest-controlled, contactless ordering, and payment. At Springline, we will be utilizing Bbot and integrating it within our Rise Buildings application to provide a one-stop solution for our tenants who wish to order from one of the many food and beverage purveyors on site.

TENANT EXPERIENCE

IOTAS

IOTAS provides smart home technology for our multifamily residences. The IOTAS app provides one-touch and voice access to smart lights, locks, plugs, shades, thermostatic control, and more, along with options to set personalized home automations according to preferences. The app has been shown to increase rents, lower turnover, reduce maintenance cost, improve energy efficiency, and speed lease-up time.

Rhino

Springline will be partnering with Rhino to provide a deposit-free experience to renters of multifamily units at the project. Rhino will significantly reduce the friction and inefficiency typically associated with an upfront deposit by allowing the tenant to pay a small monthly fee as an insurance premium. This will provide sufficient security to Springline in the event of damage or repairs upon unit turnover.

Fernish

Fernish provides a unique ‘rent-to-own’ model for one of the biggest financial and logistical pain points to relocating: furniture. Fernish has partnered with some of the top brands in designer furniture to more efficiently serve the majority of urban professionals who move, on average, at least once every 18 months. Changing tastes, home layouts and budgets have led to the rise of ‘fast furniture’: inexpensive, yet poorly designed and manufactured items that have resulted in skyrocketing waste in the industry. With Fernish, consumers can turn an upfront $5,000+ investment into a more manageable and flexible monthly rental solution, complete with turnkey delivery and installation. Customers can choose from a variety of rental durations and even have a ‘buy-it-now’ option at any point. If they wish to return the furniture or exchange for a different item, Fernish’s proprietary reverse-supply chain has been carefully designed to maximize the useful life and monetization of each piece of furniture. At Springline, we believe Fernish will help remove the friction of moving into the project while providing a more hassle-free living experience for our tenants.

Ori

Ori is a modular furniture company started by veterans of MIT Media Lab. The firm builds innovative, multifunctional, robotic-powered, smart space solutions that allow residents to effortlessly expand their living space. Tenants can conceal a bed during the workday, reveal a closet or a home office on demand, or easily divide their space at the touch of a button, a tap of a mobile app, or by voice command. Ori enables one-bedroom units to function as a one-and-half bedroom, almost a two-bedroom, and helps reduce the attrition rate of residents who outgrow their space. We will be deploying Ori’s pocket office and cloud bed solutions in almost one-third of our units (primarily junior one-bedrooms and two-bedrooms) to maximize the utility of these units to renters.

Blueport

Blueport provides managed technology solutions that enable tenants to connect effortlessly to the internet and power IoT devices, providing seamless connectivity across the entire 6.4-acre property. The firm custom designs, installs, and supports wired and wireless internet systems, with best-in-class equipment to ensure reliability and performance. Springline residents will have a single network offering turnkey connectivity for all their devices, without having to engage their own internet service providers.

WELLNESS

WELL v2 Compliance (Powered by Rise & Enertiv)

Leveraging Enertiv’s existing integration with best-in-class air quality monitoring sensors, Springline will maintain 24/7 achievement of the WELL v2 (A01 Air Quality) standards for air quality. Our system takes into account building-wide levels of particulate matter (PM2.5 orPM10), VOC testing (formaldehyde, benzine, toluene), ozone, carbon monoxide, carbon dioxide, radon, and nitrogen dioxide. By creating an integration between Rise and Enertiv, Springline will be able to display this data in real-time to tenants on the building application.

R-Zero Sanitization

R-Zero is a biosafety company that designs affordable, sustainable solutions built on a platform of IoT connected devices, revolutionizing disinfection with hardware and software technology. Products include Arc, a hospital-grade disinfectant for surfaces and air, using UV-C light rather than harmful chemicals. Disinfection can be accomplished in two minutes per room. The IoT platform delivers real-time data to the R-Zero Dashboard, so the process is visible and can be tracked, and cleaning protocols made more efficient and effective over time. R-zero recently acquired CoWorkr, a company that delivers and manages room-occupancy sensors, so that it can combine real-time data on human activity within a building with management’s cleaning and sanitization protocols. This saves time and optimizes for areas that need more sanitization, at minimal disruption to the tenant experience.

Needlepoint Ionization

Needlepoint Ionization GPS-iMOD units are installed into each rooftop air handling unit at Springline. GPS’s needlepoint bipolar ionization technology generates ions that are distributed into the air circulated in occupied spaces. These ions seek out and form bonds with particles in the air, such as dust, dander, smoke and even viruses, through a process called agglomeration. This creates a snowball effect in which particles begin to cluster together. The larger a cluster of particles becomes, the easier it is for Springline’s HVAC system to filter it out of the air.

Sanuvox BioWall

The Sanuvox BioWall UVC air disinfection system is installed in the return and supply ducting of Springline’s HVAC system to disinfect airborne mold, virus, bacteria, and carbon-based odors. The system consists of five lamps, each secured in their own parabolic aluminum reflector for maximum UVC intensity. In addition, the BioWall is installed parallel to airflow to achieve the maximum amount of contact time with airborne contaminants. This compliments our filtration and needlepoint ionization system by disinfecting any particles that are not captured by the filter.